For so many people, money is still a taboo topic. But not only is it a critical thing for us to tackle financial independence in our own lives, I deeply believe that when you teach kids how to manage their money, you empower their lives.

I am a Certified Financial Planner™, founder, investor, and I’ve written two books on money for adults. Money is my favorite thing to teach others about, and for the past two decades, empowering people financially has been a core personal and professional mission. I am also a mom of three young children, so this is something I think about all of the time in my own parenting.

Here’s the thing about money: it’s not something to worship, but it’s also not something to ignore. No matter how much money you have, being smart about how money works can be a huge lifeline–and even a superpower–as our kids grow up. Today, I’m sharing my favorite tips for kids so you can walk away with a few ideas to start speaking with your little ones about money.

7 ways to teach kids about money

1. Create healthy money associations

Here’s something we can all do today: start creating healthy money associations with your children. You want them to associate money with positive things. For example, helping them connect the dots between working hard, earning money, and using that money on things they are super excited about. I’d go so far as to teach them simple money mantras:

- Money is something I can manage

- Money is a tool that helps me live my life

- I will be strong and thoughtful with my money

2. Establish money goals

We all have important goals in our lives that motivate us. Some of those goals are short-term, and some are long-term. Delayed gratification is an essential skill for our children to learn. Teach them to put aside money today for something they can enjoy in the future. You can even do this on the family level: maybe you turn a piggy bank into a fund for your next family vacation. Ask your kids to create some goals today, and allocate specific piggy banks to save for those goals so they can track their progress.

3. Encourage them to earn

We all know about the proverbial lemonade stand. Teaching our kids to earn at a young age can start to build their confidence, showing them that they are bright and capable. Perhaps they already earn an allowance, but also encourage them to consider starting a business. Are there skills they have or things they’re passionate about? Maybe your kids like to bake, and you can encourage them to start a cookie company. My daughter has a bracelet business, which lets her lean into her artistic side. Remember, all entrepreneurs have to start somewhere!

4. Hone their saving habits

From this moment forward, have your children think of themselves as little chipmunks when it comes to money. Every time they earn money, encourage them to stash some away so that they have money for their future goals.

5. Learn the 50/20/30 budgeting method

Teaching your kids an easy budgeting framework is the perfect way to distill the difference between wants and needs. A simple budgeting tool I live by is the 50/20/30 rule. 50% of the money you make should go towards your must-haves. 20% of the money goes into saving for the future (remember the chipmunk). And the remaining 30% can be spent on fun decisions you get to make each day, like going to get ice cream with a friend. Whenever your child receives money—be it as a birthday gift or business earnings—encourage them to divide it up into each of these categories before spending.

6. Open up a bank account

If your child doesn’t have a bank account yet, consider getting them a checking account (an account that they regularly move money in and out of) and a savings account (an account for money that they plan to store for a longer period of time and earns them interest). Here are a few questions to discuss with your kids so that they start to understand how to make these decisions:

- Does the bank have many physical locations or is it all done online?

- Are there fees that you’ll be charged for the account?

- Why is it important for my money in my savings account to earn interest? What is interest, and how much will this account earn?

If you already have a bank account set up for them, make sure to show them their monthly bank statements, so they can start to see the real world impacts of their money decisions.

7. Teach the value of investing

I always love to explain investing as making your money work for you—even while you’re sleeping. The easiest way to learn about the stock market is to have your kids do some research themselves. Encourage them to choose a big company that they are interested in, perhaps Apple or Disney. Here are a few questions they can start to research:

- What is the stock symbol?

- What is the current share price?

- How much is the whole entire company worth?

- How much has the stock gone up or down in the last year?

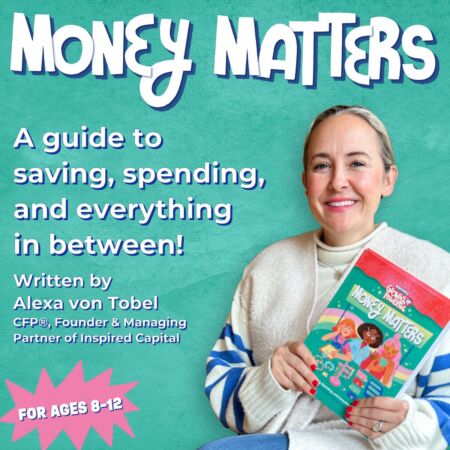

As we head into Financial Literacy Month, there’s no better time to open up a dialogue about money with your children. Money Matters is a tool for parents who want to play offense, so please join me and the rest of the Rebel Girl community as we empower our children to understand their wallets!

Rebel Girls Growing Up Powerful: Money Matters

This story is a part of The Motherly Collective contributor network where we showcase the stories, experiences and advice from brands, writers and experts who want to share their perspective with our community. We believe that there is no single story of motherhood, and that every mother’s journey is unique. By amplifying each mother’s experience and offering expert-driven content, we can support, inform and inspire each other on this incredible journey. If you’re interested in contributing to The Motherly Collective please click here.