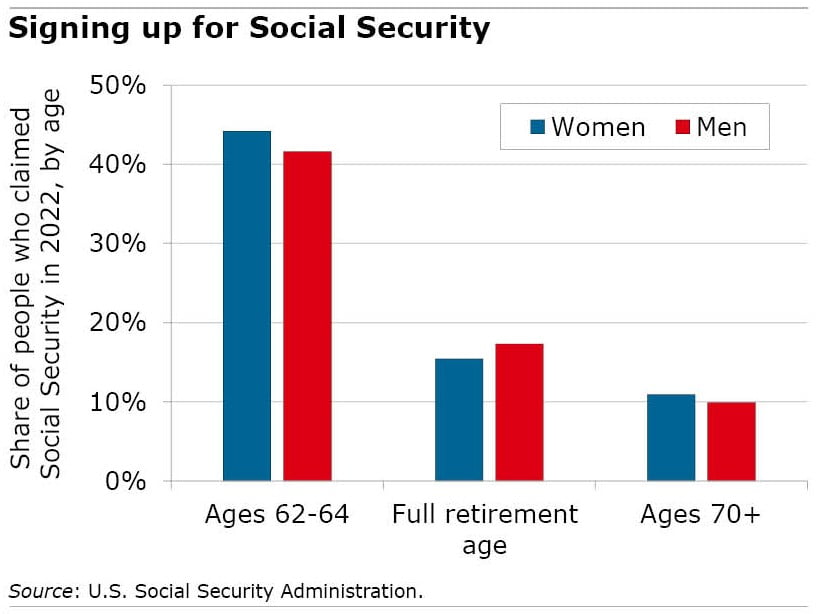

Financial advisers often encourage older workers to delay signing up for their Social Security as long as possible to maximize their monthly income.

But several of our blog’s readers point out, rightly, that this isn’t always possible for people in physically taxing jobs. Blue-collar workers are in a real Catch-22, caught between the unforgiving financial demands of retiring and a body that can’t take any more work.

“That’s me,” a reader named George L. commented on a recent blog, “The Psychology Behind Starting Social Security at 62.” Psychology had little to do with his decision to start Social Security. “I worked unskilled hard labor all my life so I was ready to retire at 62,” he said.

Another reader, Ellis, said he knows retired linemen, construction workers and truck drivers.

“They were just worn out by 62, and continuing to work in their occupations would be exceedingly taxing and dangerous due to declining abilities,” he said. “Work like that can take years off a life.”

But for another reader, financial security – his wife’s – was the primary consideration in deciding when to start Social Security. David Scarborough said he earns more than his wife and wants to make sure she has a large enough spousal benefit from his Social Security since “I am quite likely to die before she does.”

It is, he said, “in both of our interests for me to delay claiming.”

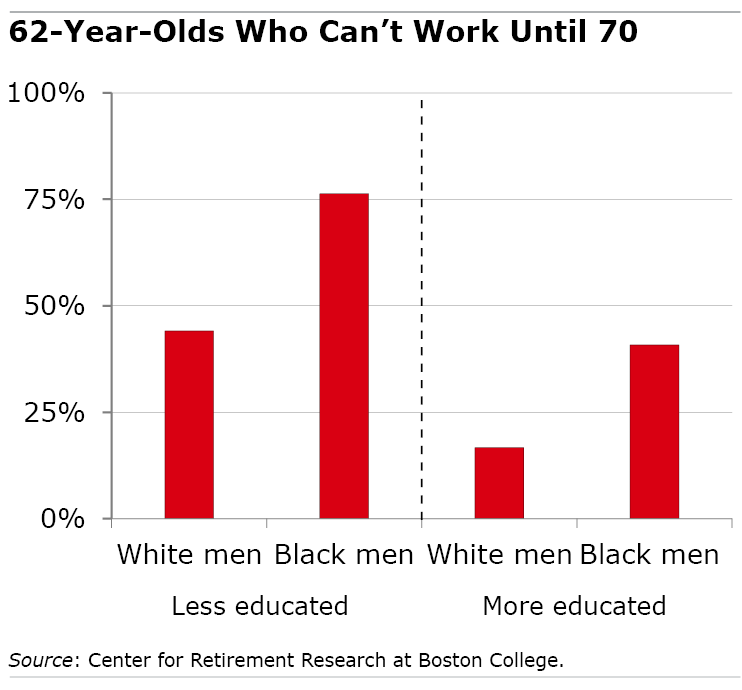

Research shows that how much someone earns is a big factor in when they decide to retire. People in physically demanding jobs, who may feel they can’t work any longer, also tend to earn less and might have a lot to gain from delaying their benefits – if only they could. Workers who have the luxury of delaying are often in relatively cushy or high-paying office jobs or are doing work that energizes them, rather than wearing them out.

“It is easy for an accountant or librarian to stay working full-time until 70,” Dr. Edward Hoffer said, “but not so easy for a roofer or custodian.”

A 2021 study revealed this deep socioeconomic gap, which runs along racial lines. Only one out of five college-educated White men wouldn’t be physically able to work until 70. At the other end of the spectrum, three out of four less-educated Blacks could not make it that long.

Although readers focused on the financial issues involved, some acknowledged one psychological aspect of deciding when to start Social Security: the expectation of how long they will live.

The research featured in this blog shows that people who expect to live longer delay claiming their benefits. The contrast is with people who hold the opposite view – that “life is short” – and feel that it’s important to grab the benefits as soon as possible and enjoy their retirement years.

“I’ve seen enough of my peers/family pass away in their 60s and 70s,” said Deanna, another reader.

The way Social Security’s formula works is that the larger checks a retiree receives by delaying will, if they live long enough, eventually make up for the “lost” years of benefits caused by waiting. Every year of delay will increase the size of that monthly benefit check by 7 percent to 8 percent, which is substantial. Claiming at age 62 or 64 to enjoy retirement has a steep financial cost for people with average or above-average life expectancy.

Brian Krech and his wife plan to split the difference. Krech, who said he has serious health issues, plans to start his benefits early. His wife will wait until 70.

“If you are relatively healthy and longevity runs in your family, it’s a no-brainer to hold off and claim at 70 to maximize your benefits,” he said.

But this is an option that wouldn’t work for other couples. First, the Kreches both have similar earnings, eliminating the issue of needing to maximize the spousal benefit – in contrast to the reader who earns more than his wife. And Krech’s wife apparently has the kind of job that allows her to delay Social Security – in contrast to aging blue-collar workers who struggle to keep up with the physical demands of their jobs.

“Each personal and family situation is so different that it’s critical to look at all options and rationale before claiming your Social Security benefits,” Krech said.

Every worker’s situation is different. But the ability to work longer is also a big part of the equation.

To read the study by Suzanne Shu and John Payne, see “Social Security Claiming Intentions: Psychological Ownership, Loss Aversion, and Information Displays.”

The research reported herein was derived in whole or in part from research activities performed pursuant to a grant from the U.S. Social Security Administration (SSA) funded as part of the Retirement and Disability Research Consortium. The opinions and conclusions expressed are solely those of the authors and do not represent the opinions or policy of SSA, any agency of the federal government, or Boston College. Neither the United States Government nor any agency thereof, nor any of their employees, make any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of the contents of this report. Reference herein to any specific commercial product, process or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply endorsement, recommendation or favoring by the United States Government or any agency thereof.